14

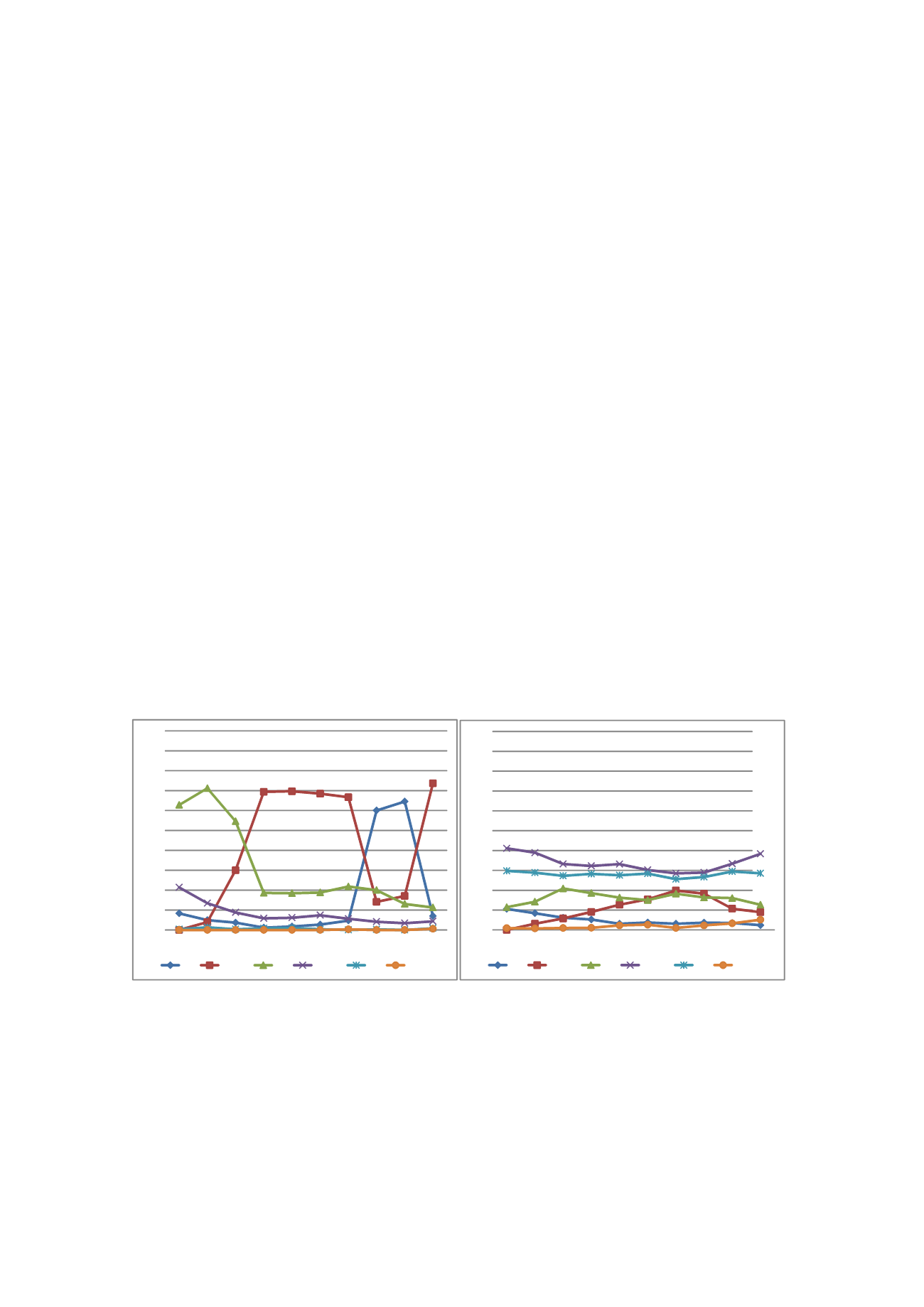

retirement at the age of 55, while between 5 to 10 percent only of the cohorts born

1931-1932 did. The most prevalent age of retirement for the non-military employees

across all cohorts is between the ages 61-64; the second most common age of

occupational pension incidence is age 65. For the non-military there is a rather stable

fraction of retirees at age 60, while there is a tendency toward an increase in the fraction

receiving occupational pensions at 56-59 years of age.

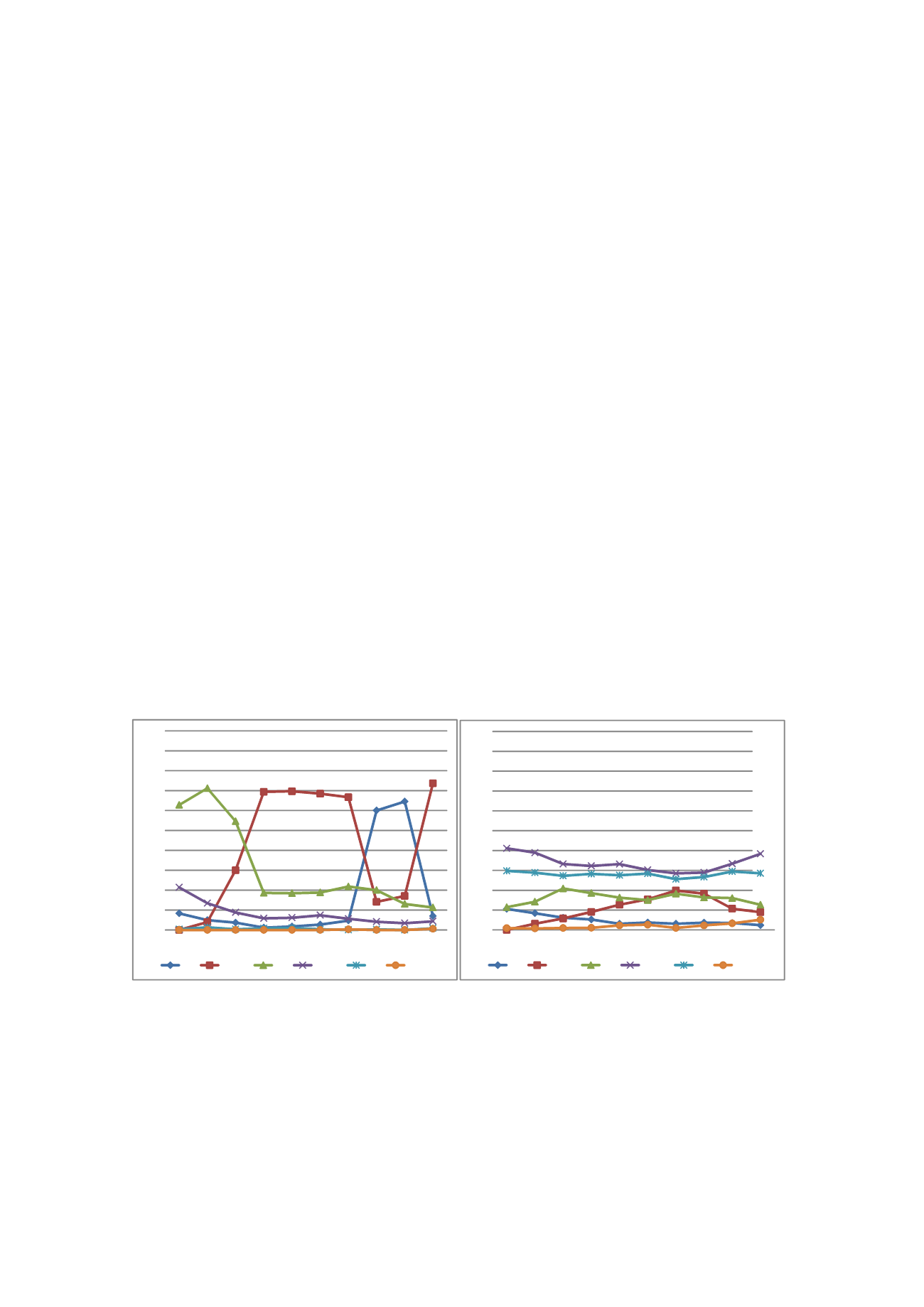

In order to provide further graphical evidence of the validity of the reform, we

display the probability of having occupational pensions, of having labor income, and of

being registered as gainfully employed according to the ILO definition, for the cohorts

1938-1939 and 1931-1932 for both military and non-military government employees in

and

respectively. From these figures it is clear that the

Defense Bill affected the fraction that received occupational pensions, thereby also

affecting the age of retirement (measured as the leap in either the take-up rate of

occupational pension or fraction employed) for the military personnel born 1938-1939.

There is no similar discontinuity for the same cohorts among the non-military

government employees. Furthermore, the alternative measures of labor market status tell

the same story.

Figure 1: Retirement age (first year with occupational pension take-up) by birth cohort,

percent (fractions sum to 100 per birth cohort); birth cohorts 1931-1940; military

personnel (left) and other government employees (right)

0

10

20

30

40

50

60

70

80

90

100

1931

1932

1933

1934

1935

1936

1937

1938

1939

1940

55

56-59

60

61-64

65

66-70

0

10

20

30

40

50

60

70

80

90

100

1931

1932

1933

1934

1935

1936

1937

1938

1939

1940

55

56-59

60

61-64

65

66-70