9(27)

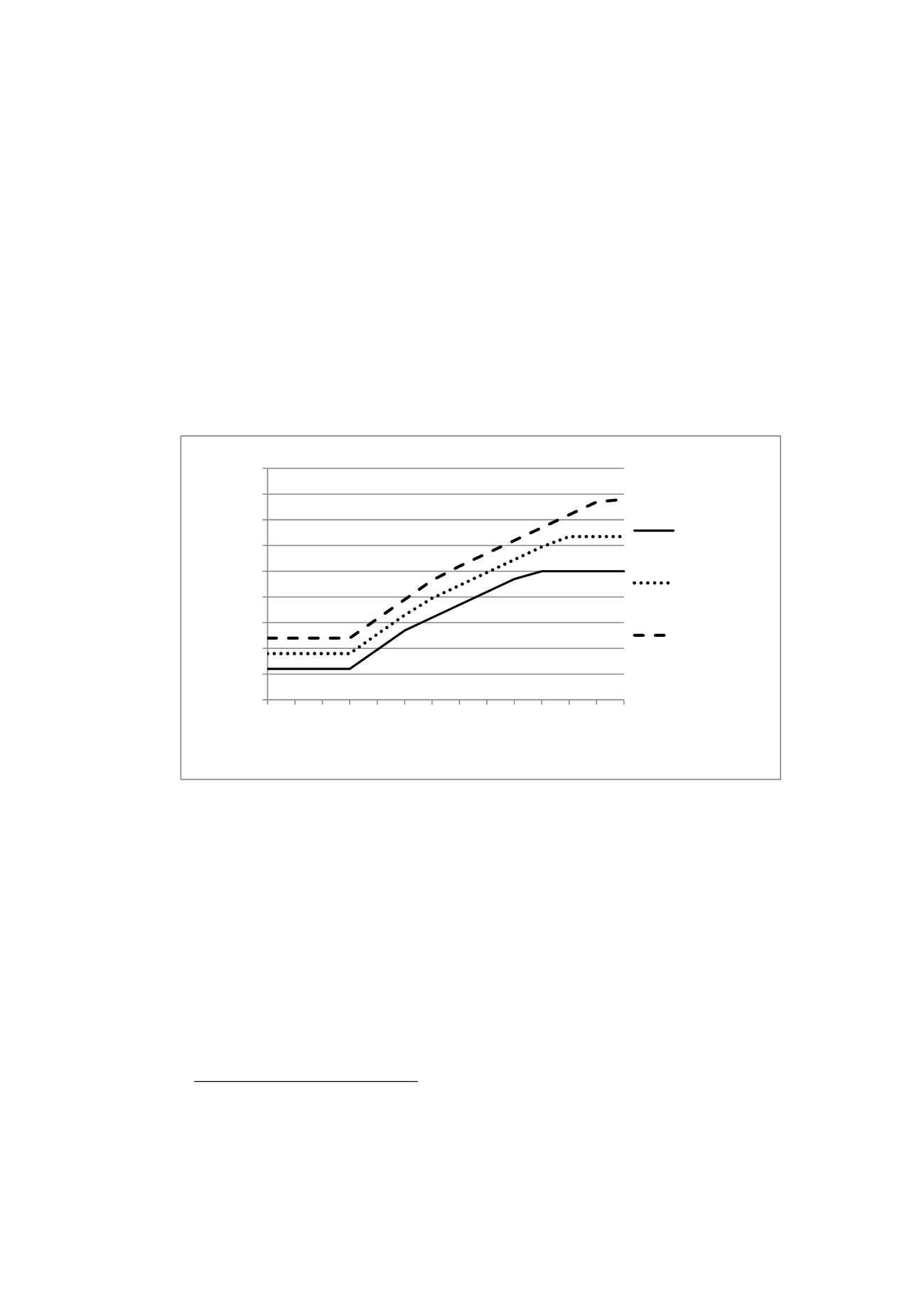

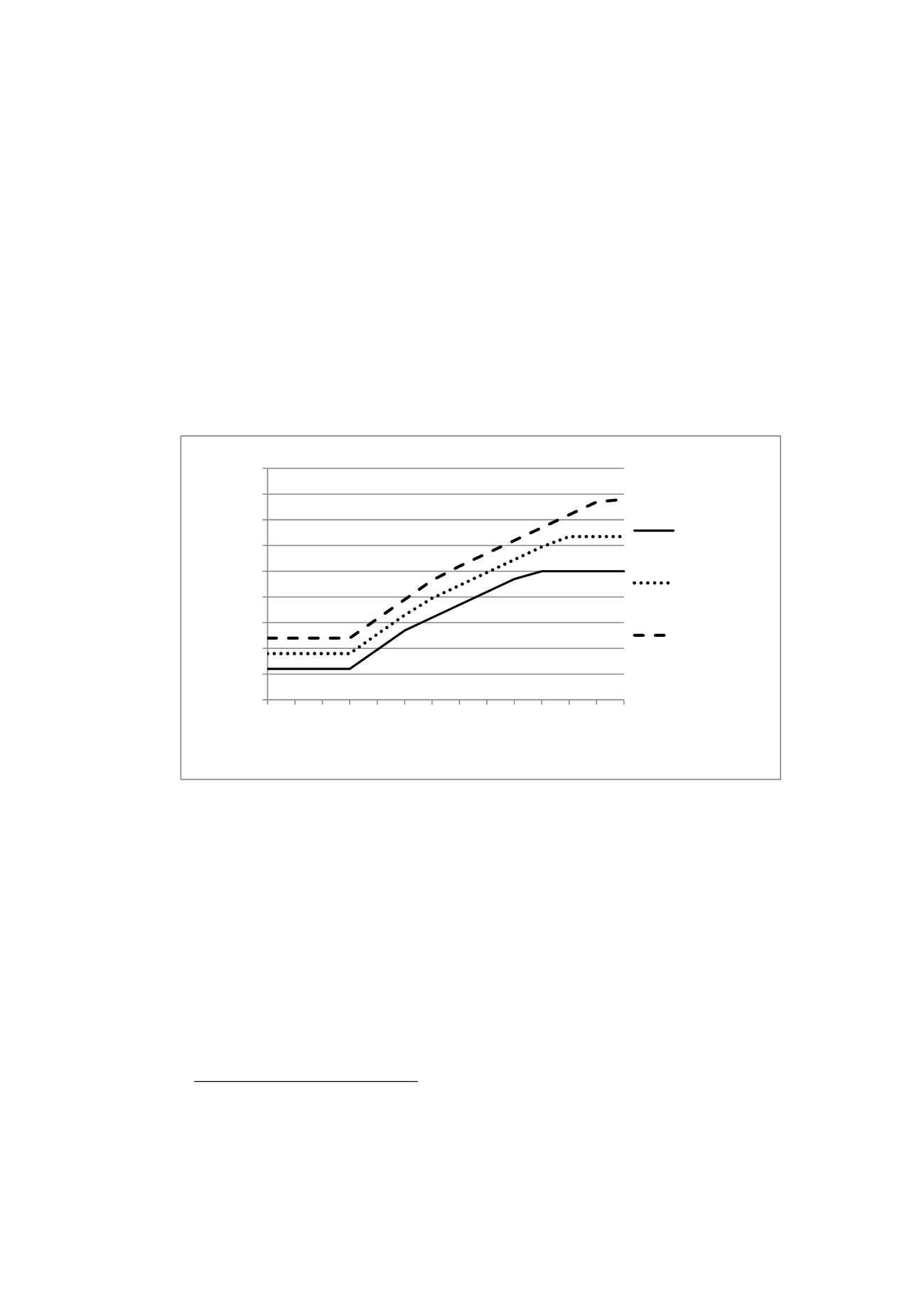

0

500

1000

1500

2000

2500

3000

3500

4000

4500

500

1000

1500

2000

2500

3000

3500

4000

4500

5000

5500

6000

6500

7000

Household with

1 child

Household with

2 children

Household with

3+ children

Housing expenses [SEK/month]

Maximum housing allowance [SEK/month]

The calculation of the Swedish housing allowance is a variation of the “gap

formula” (see, e.g., Fallis, 1990, p.381–382). The allowance, which each

household must apply to receive, is intended to cover a certain part of a

household’s housing expenses. The allowance increases with the number of

children in the household, and is reduced by an income-related amount.

More specifically, the allowance is based on a combination of household

type and size, household housing expenses, household income, and

dwelling size. There is an additional special allowance, a general income

support, which, as it is based solely on the number of children in the

household, cannot be considered a housing allowance. The Swedish housing

allowance therefore consists of both general income support and specific

housing support, the maximum allowance comprising three elements: 1) a

special allowance based on the number of children;

6

2) 75% of housing

expenses between specific levels; and 3) 50% of housing expenses

between (higher) specific levels,

according to

Figure 1.

Figure 1. The Swedish housing allowance schedule for single parents,

1994-1999.

Furthermore, for single parents, the monthly income limit is SEK 9750,

7

the

allowance being reduced by 20% of any income earned above this limit.

This implies that the gap formula for the Swedish housing allowance, for a

single parent with one child and housing expenses of SEK 3000–

5300/month, could be expressed as:

HA=600 + (HE – 3000)0.50 + (3000 – 2000)0.75 – (I – 9750)0.2 where,

HA =

household housing allowance [SEK/month],

HE =

household housing expenses (i.e., the rent paid by a renter)

[SEK/month], and

I =

household income before tax [SEK/month].

6

Children may be considered household members until they reach age 18. However, this age

limit can be raised if the children attend high school and receive a student grant or if they are

studying and receive an extended child allowance.

7

“Income” here is the household income before tax.